Acadia Healthcare (ACHC) Shares 12% on Q2 Earnings Beat

Parts of Acadia Healthcare Company, Inc. ACHC has gained 11.6% since reporting earnings for the second quarter of 2024 on Jul 31. Results benefited on the back of growing patient numbers, which remain the most important part of the top line. of a health care facility.

High patient days, steady demand for behavioral health services and attractive growth-related initiatives remained other tailwinds for the company. Management expects further volume growth in the second half of 2024 as facilities and beds increase. However, the effect was partially offset by high costs.

ACHC reported adjusted second-quarter earnings of 91 cents a share, beating the Zacks Consensus Estimate by 3.4%. However, the bottom line is down 1.1% year over year.

Total revenue increased 8.8% year over year to $796 million. The upper limit exceeded the consensus mark by 1.5%.

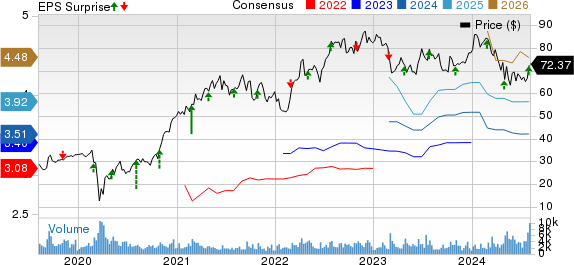

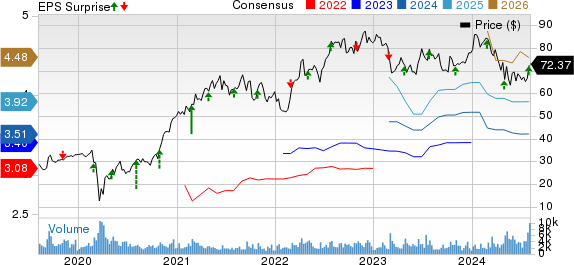

Acadia Healthcare Company, Inc. Price, Consensus and EPS Surprise

Chart of Acadia Healthcare Company, Inc Acadia Healthcare Company, Inc

Q2 performance

Same-store sales of $776.1 million were up 8.3% year-over-year but fell short of our estimate of $776.4 million. The year-over-year improvement was driven by a 5.6% increase in revenue per patient day and a 2.6% increase in patient days.

Admissions rose 0.7% year over year. Average length of stay grew 1.8% year over year but missed our estimate of 2% growth.

Center-wide, patient days increased 2.6% year-over-year while admissions increased 1% year-over-year. Revenue per patient day improved 6.1% year-over-year, which was higher than our 6% growth estimate. Average length of stay rose 1.6% year over year but missed our estimate of 2.9% growth.

Adjusted EBITDA rose 7.6% year over year to $187.6 million but fell short of our estimate of $190.1 million. Adjusted EBITDA growth remained flat year over year at 29.5%.

Total expenses of $689.6 million were up 8.6% year over year, higher than our estimate of $674.9 million. The annual increase was due to higher salaries, wages and benefits, professional fees, other operating expenses and interest expenses.

Financial Update (as of July 30, 2024)

Acadia Healthcare exited the second quarter with cash and cash equivalents of $77.2 million, which was down 22.9% from the end of 2023. It had $371.5 million of cash remaining under its credit facility. of 600 million dollars at the end of the second quarter.

Total assets of $ 5.7 billion increased 6% from the figure of 2023 at the end.

Long-term debt reached $ 1.8 billion, which increased by 32.2% from the figure as of Dec 31, 2023. The current portion of long-term debt was $ 66,6.

Total equity of $ 3 billion advanced 6.1% from the end of 2023. The ratio of net leverage was close to 2.5X at the end of the second quarter.

Total operating income reached $150.1 million in the first half of 2024 compared to total operating income of $208.2 million in the comparable period last year.

Business Promotion

Acadia Healthcare added 37 beds to its existing facilities in the second quarter. It also established another acute care hospital, called Agave Ridge Behavioral Hospital, in Arizona.

The 2024 guide has been updated

Revenues are estimated to be between $3.18 billion and $3.225 billion compared to the previous range of $3.18-$3.25 billion. The center of the updated vision shows a 9.3% improvement from the 2023 figure.

Adjusted EBITDA is estimated to be $735-$765 million compared to previous guidance of $730-$770 million. The mid-range of the updated outlook shows growth of 10.7% from the 2023 figure.

Adjusted earnings per share (EPS) are forecast to be between $3.45 and $3.65 compared to the previous guidance range of $3.40-$3.70.

Interest expense is estimated to be in the $110-$120 million range. Depreciation and amortization expenses continue to be expected in the $150-$160 million range. The tax rate is still expected to be within 24.5-25.5%. The cost of property repairs is still expected to be between $40 million and $45 million.

Operating cash flow is forecast in the $525-$575 million range. The capital cost of the expansion is expected to be between $425 million and $475 million. Maintenance costs and IT capital continue to be expected in the $90-$110 million range.

The administration is estimating to add more than 400 beds to the existing facilities by 2024. It intends to inaugurate a maximum of 14 full treatment facilities. ACHC expects to open four patient centers in the second quarter of 2024, with two new joint centers.

The Zacks Rank

Acadia Healthcare currently has a Zacks Rank #3 (Hold). You can see a complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Branch Releases

Of the medical sector players that have reported results for the second quarter of 2024 to date, the primary results of Tenet Healthcare Corporation THC, Universal Health Services, Inc. UHS and The Ensign Group, Inc. ENSG beat the separate Zacks Consensus Estimate.

Tenet Healthcare reported second-quarter 2024 adjusted EPS of $2.31, which beat the Zacks Consensus Estimate by 22.2%. The high level rose to 60.4% year over year. Operating income of $5.103 billion was up 0.4% year over year. The top line hit the consensus mark by 2.5%. Adjusted revenue of $226 million was up 46.8% year over year. Adjusted EBITDA was $945 million, up 12.1% year over year. Adjusted EBITDA margin of 18.5% improved 190 bps year over year.

Operating income for the Hospitals Operations and Services segment fell 4.3% year over year to $3.96 billion. On a same-hospital basis, patient services revenues advanced 8.2% year over year. The Ambulatory Care segment reported operating income of $1.14 billion, up 21.1% year over year.

Universal Health reported second-quarter adjusted EPS of $4.31, beating the Zacks Consensus Estimate by 27.9%. The primary level is up 70.4% from last year. Net income reached $3.9 billion, up from $3.6 billion last year. The upper limit exceeded the consensus mark by 1.5%. NCI’s adjusted net EBITDA rose 35.9% year over year to $578.7 million. In the Acute Care Hospital Services department, adjusted admissions (adjusted for outpatient work) increased by 3.4% year-over-year in the same area. Adjusted patient days increased by 1.6% year over year. Revenue from Universal Health’s intensive care services improved 6.6% year-over-year on a like-for-like basis.

In the Behavioral Health Care Services segment, adjusted admissions decreased 0.4% year-over-year on a same-facility basis. Meanwhile, adjusted patient days increased 1.4% year over year, below our model estimate of 1.9%. Similarly, revenues from UHS health services increased by 11% year over year.

Ensign Group reported second-quarter 2024 EPS of $1.32, beating the Zacks Consensus Estimate by 2.3%. The bottom line increased by 13.8% year over year. Operating income of $1.04 billion improved 12.5% year over year. The upper limit exceeded the consensus mark by 2%. Ensign Group’s adjusted revenue grew 15.3% year over year to $76.4 million.

Same-store stays improved 280 bps year-over-year while repeat stays expanded 430 bps year-over-year. Knowledge Services segment revenue rose 12.1% year over year to $991.3 million. Segment income of $122.2 million improved 4.4% year over year. Skilled nursing jobs in the division’s campus were 272 and 29, respectively, at the end of the second quarter. At Standard Bearer, Rental revenue reached $23.4 million, up 17.3% year over year.

Looking for the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Tenet Healthcare Corporation (THC) : Free Stock Analysis Report

Acadia Healthcare Company, Inc. (ACHC) : Free Stock Analysis Report

The Ensign Group, Inc. (ENSG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

#Acadia #Healthcare #ACHC #Shares #Earnings #Beat